Best Practice

Keeping an eye on oil inventory levels is a best practice every good production accounting group should do. At least once a week the volumes in child tanks should be reviewed to ensure loads are being called in to dispatch by field offices and picked up by purchasers. Oil inventory shouldn’t be stockpiled in tanks unless there’s a valid reason an organization wants to do so, such as use in drilling, hot oiling or if the organization is waiting for higher oil prices.

Write a Report

I like to have a report that shows me every child tank with no change in gauges for at least 30 days. Adding additional filters is useful, such as being able to filter to every child tank that has at least 50 bbls with no change in the past 30 days, or the ability to select a specific date range. When you write a report, make sure the field can’t trick it by deleting a daily gauge in the field collection software and then re-entering the same gauge. A report needs to pull in tanks based on actual gauged levels and not on records that haven’t changed because re-entering an existing gauge and “touching” that record will cause that tank to be excluded from the report. One exception that needs to be considered when reviewing tank volumes is when tanks on a location are equalized-those gauges aren’t going to change very often. If your organization tracks gun barrel tank volumes, then those should also be excluded as an exception. Anything on pipeline you have little control over and can monitor, but tanks on pipe generally have regular sales.

Keep Tanks Kolor Kut

Look to see if there’s a kolor kut on the tanks and if that kolor kut ever changes. You may need to contact the field and ask if the volume in your report for specific tanks is all good oil? Or is some of that volume BS&W that isn’t being identified as such. Putting a kolor kut on a tank is another best practice. Even an estimated one is better than nothing and helps maintain the integrity of regulatory reporting. The U.S. government and the states all track inventory, by location. Some states, like Texas, will not allow a change to be made to inventory in a current month by adjusting oil volume down and increasing water production if it’s discovered that some of the “oil” in a tank was actually water. In Texas, you must either go back into prior months and make those adjustments and refile all the affected months or hold your oil inventory steady until you actually do have that much oil volume in your tank. Ex: I said my tank had 100 BO but found out it really had only 80 BO. I must report 100 BO as ending inventory every month until there actually is 100 BO in that tank. Or I must go back into daily records and adjust the oil and water volumes to reflect that there’s just 80 BO then refile the months I made adjustments in. Federal wells require you to go back and adjust the daily records-you don’t get the choice of holding an ending inventory gauge. Federal wells also require a kolor kut on every tank.

Short Load Sales

A typical trucked load of oil is 180 bbls. In parts of the Bakken area, it’s over 300 bbls. Leaving inventory on location can result in stolen bbls or a bigger loss if a location is struck by lightning. Oil sitting in tanks for months turns to junk and may require chemicals to get it sellable. Most purchasers are happy to fill their slower weeks picking up short loads, you just have to work it out with them in advance. I always find it helps to get an idea from the field if there are other tanks in an area where I want a short load hauled that have enough oil in them to “top off” a short load and give the transporter a full 180 bbls. If you have wells that haven’t had sales in a while and currently aren’t under contract, work with your marketing group and consider doing a spot sale for those short loads.

Getting tanks sold before winter weather arrives is ideal as valves sometimes pop off in a freeze which can result in a spill. Instead of hauling short loads, you can also move smaller volumes by a bobtail transport, which can haul around 80 bbls, and transfer the oil to another tank battery to make a full load. Just don’t forget to enter a transfer ticket into your software so the owners at the location where the oil was moved from get paid when the oil sells at the location it was all moved to.

Long term shut-in and plugging

If you know that a well is being shut-in long term or is about to be TA’d or PA’d, then it’s imperative to get tanks sold. Either transfer oil to other locations so the inventory gets sold off with regular sales elsewhere or let the purchaser know you’re about to shut-in, TA or PA a well and you need to get a short load hauled. If neither of these is an option, then make sure the field still checks those tanks once a month. I have seen wells shut-in for long periods have entire tanks of oil stolen when no one is continuing to check the location. This is a common occurrence in the Permian Basin.

Track Sales Progress

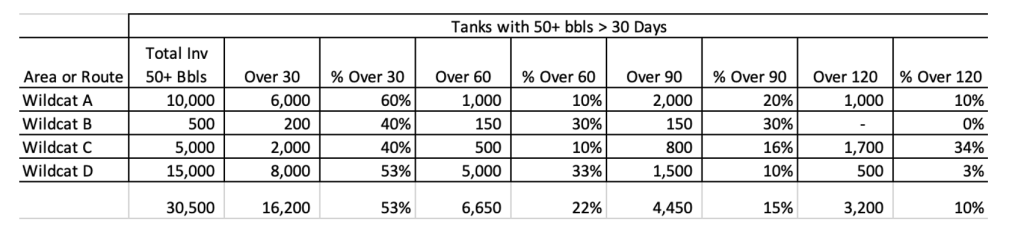

Keep track of the child tanks with inventories you’re trying to get sold. You might arrange your list by area or route which will also help identify internal issues within an operations group. A good metric to track is to show percentage of oil in tanks with greater than 50 bbls for greater than 30 days vs total oil in tanks. You can break it down further and show the bbls and percentage of oil that’s been sitting in tanks for more than 30 days, 60 days, 90 days, 120+ days. See my example below:

Wildcat A is holding 60% of its inventory between 31-90 days before it’s sold. For all the tanks with at least 50 bbls in them, more than half of them have inventory sitting for more than 31 days instead of selling faster. Questions I’d ask would be:

- How many tanks have 180+ bbls that can be sold immediately?

- Is there a problem with purchasers picking loads up? Weather related?

- Are loads being called in to dispatch?

- Is that all good oil in the tanks or is some of it BS&W?

- Is the organization hanging onto the inventory for a specific reason?

Since a full load is typically 180 bbls, it appears that Wildcat B is turning inventory over well with no major issues.

Wildcat C has some old inventory that needs to be reviewed since 50% of it has been sitting in tanks for 90+ days. This area seems to be selling oil slowly, with 40% of inventory selling between 31-60 days.

- How many tanks have 180+ bbls that can be sold immediately?

- Are these gas wells and it just takes longer to fill the tanks?

- For the older oil, are chemicals required to clean the tanks up so sales can occur?

- Are there tanks located near each other geographically and under contract with the same purchaser that can either be set for short load sales or combined to make a full load?

Wildcat D looks like it’s also turning inventory over slowly so I’d review what could be sold immediately, what could be set for short load sales or combined with other tanks and check to see if this area just takes longer to fill tanks up. I’d ask the same questions noted above for Wildcat A. There is an added cost to utilize a bobtail to transfer oil, so I wouldn’t ask the field to combine tanks more than a couple times a year.

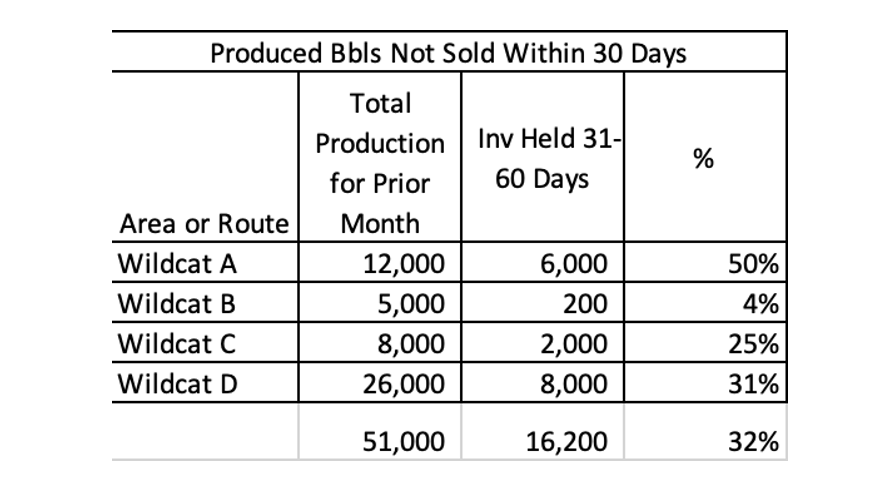

Another check would be to pull a report that provides 100% of total oil production for the prior month and compare that against inventory that didn’t sell within 31-60 days.

Wildcat A half of its production sat in inventory instead of selling.

Wildcat B sold most of what it produced.

Wildcat C and D look to have some slow sales, but again it could also be wells that don’t make as much oil which don’t have regular sales every month.

I would watch these trends and work with the field management and marketing teams to establish benchmarks. If 25% is normal for Wildcat C then this test shows it’s within its normal trend and will hopefully sell off some of that inventory within the next month. You can check by looking at the earlier table where only tanks with at least 50 bbls is captured and see that old inventory > 60 days is only 500 bbls. Either the inventory got sold, or there isn’t at least 50 bbls in the tanks and it will take time to produce enough for a full load.

Budgeted Sales vs Actual Sales

Sales is something management and asset teams watch closely. If your software has had the estimated sales bbls loaded by month or quarter, you can easily compare those volumes by area or route against actual sales. If sales targets aren’t being hit and have nothing to do with a lag in the drilling or workover schedule, then your answer may appear in your report showing tanks with 50+ bbls > 30 days. Review the answers you received when questioning why you have old inventory in tanks.

Summary

If oil inventory isn’t managed well an organization can lose profits. Money was spent to drill and bring a well online. Sales is how an organization recoups those expenses so make sure you’re managing the inventory and it’s selling. Track older oil inventory to draw awareness to the fact that it’s there and help your field team to get it cleared and sold. Managing inventory also helps guard against having to refile regulatory reports.

If managing oil inventory is something your organization would like help with, please contact me to schedule an assessment to help you achieve your goals.

Monitoring oil inventory levels is crucial for maintaining accuracy and efficiency in production accounting. Regularly reviewing child tank volumes helps ensure that loads are dispatched and picked up correctly. Implementing effective reporting systems can prevent potential issues with data integrity, such as re-entering old gauges. Exceptions like equalized tanks and specific types of storage should be carefully considered in the review process. How can organizations improve transparency and accuracy in identifying BS&W in reported oil volumes? WordAiApi